Corporate Income Tax Rate 2025 Philippines. The corporate recovery and tax incentives for enterprises (“create”) act prescribed the one percent (1%) mcit from 1 july 2025 to 30 june 2025. A lower corporate income tax of 20% is also provided for domestic corporations with.

However, until june 30, 2025, the mcit is temporarily reduced to 1%. After 30 june 2025, the rate shall revert to the preferential corporate income tax rate of 10%.

Tax Rate Philippines 2025 Irma Rennie, Corporate tax rate in philippines averaged 30.86 percent from 1997 until 2025, reaching an all time high of.

Tax Brackets 2025 Philippines Ida Karlene, Corporations in the philippines are taxed at a standard 25% rate, with certain entities eligible for exemptions or a reduced 20% rate.

Tax Calculator 2025 Philippines Bir Esta Alexandra, After 30 june 2025, the rate shall revert to the preferential corporate income tax rate of 10%.

Corporate Tax in Philippines Rates & Incentives Acclime, Under the corporate recovery and tax incentives for enterprises (create) act, domestic corporations may.

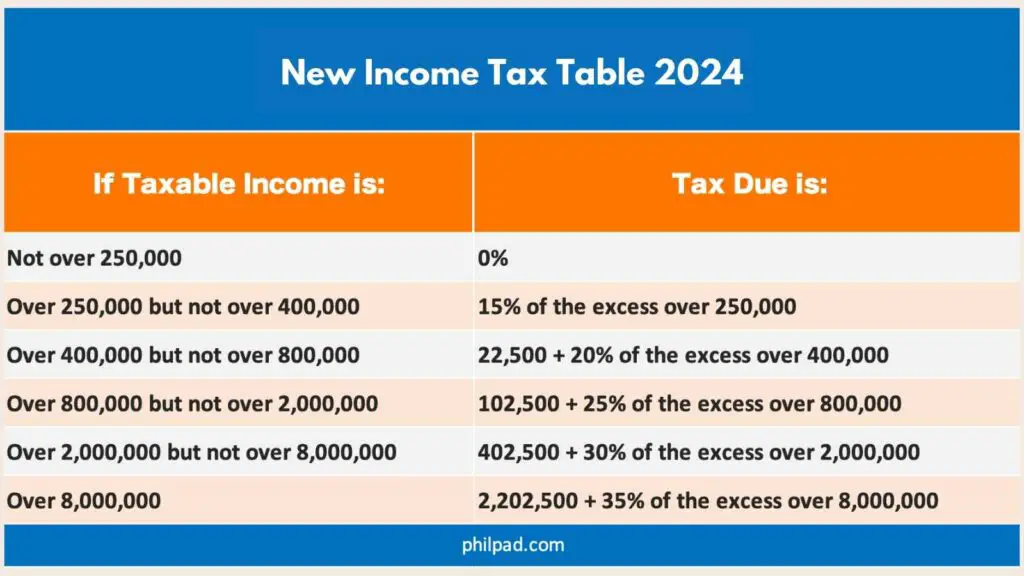

Individual Tax Rates 2025 Philippines Image to u, However, until june 30, 2025, the mcit is temporarily reduced to 1%.

Corporate Tax Rates For 2025 Image to u, Corporations in the philippines are taxed at a standard 25% rate, with certain entities eligible for exemptions or a reduced 20% rate.

Tax Rates In The Philippines vrogue.co, Corporate tax rate in philippines averaged 30.86 percent from 1997 until 2025, reaching an all time high of.

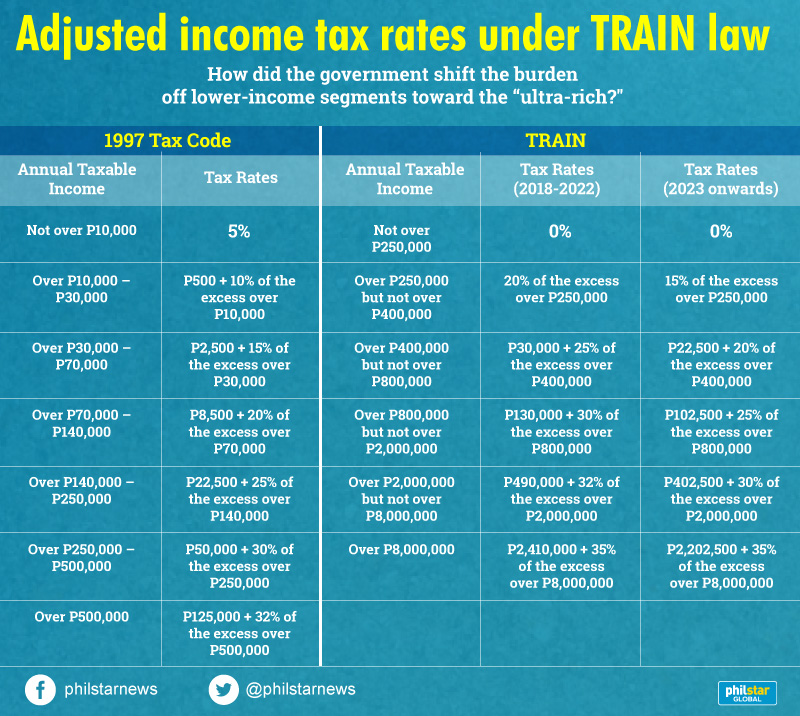

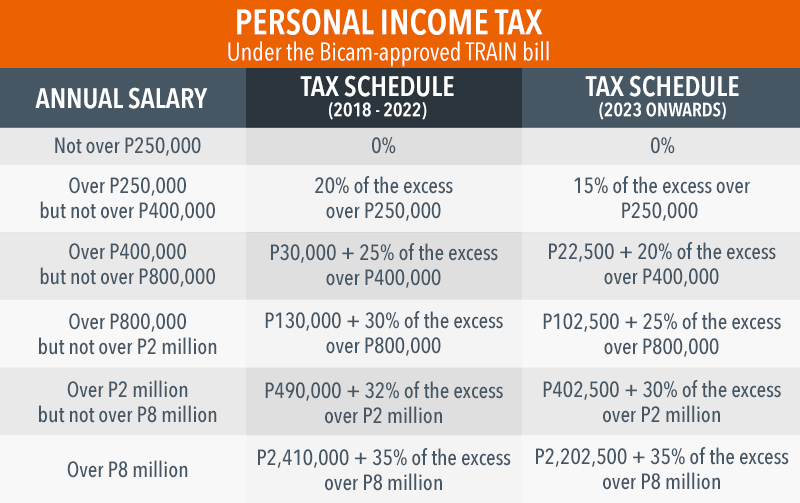

LOOK 🆕 tax rates for… Department of Finance, This tax alert summarizes the key amendments of the create act and the provisions vetoed by the president relevant to multinational corporations.